The latest COMREG quarterly telecomms market report is out.

These reports are useful for anyone in the Irish telecoms industry. They cover fixed voice, mobile voice, broadband and broadcasting.

A few points stand out in the mobile section of the latest report:

- Overall Irish mobile revenue is down 1.2% in the last twelve months (p. 6).

- The mobile penetration rate was 118.3% including mobile broadband and Machine to Machine subscriptions, and 99.5% excluding mobile broadband and Machine to Machine [M2M] subscriptions (p.8).

- Fixed voice subscriptions have grown 3.9% in the last 12 months (That seems counterintuitive – perhaps it’s being driven by the growth in converged bundles?).

- Two-thirds of all voice call minutes are from mobile (p. 12). No surprise there.

- There are 340k ‘Machine-to-machine’ subscriptions within the mobile base (p. 49) which equates to 7.4% of the lit SIMs. O2 have the lion’s share of the market (p. 60). Well done O2!

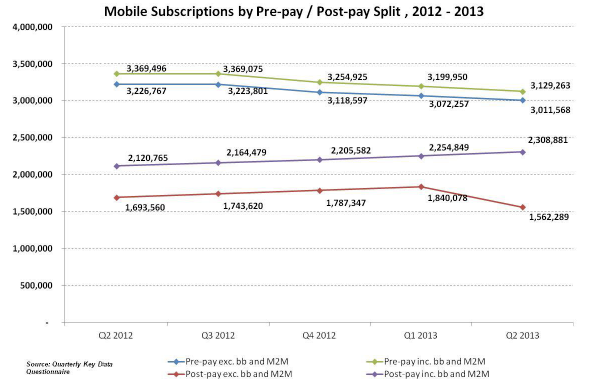

- Fig. 4.2.2 suggests the growth in postpay subscribers is coming from M2M and broadband subscriptions – interesting. It seems that if we exclude the data-only SIMs, prepaid voice is declining a little, and postpaid voice is falling faster.

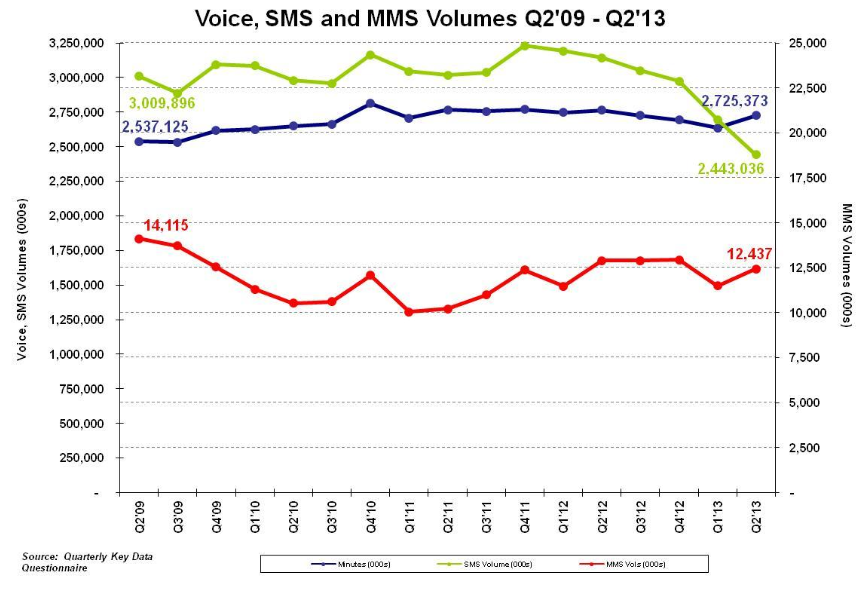

- Fig 4.3.1 shows that voice minutes continue to decline, and SMS messages outnumber voice minutes for the first time. This has been a long time coming. I had lunch with a former CEO of Eircell last week, where he reminded me of the surprise in the telecoms industry when Eircell achieved half a million text messages a month. How far we have come! Moreover, the uptick in SMS volumes gives the lie to the notion that over-the-top (OTT) services are heavily cannibalising SMS traffic.

- Eircom (Meteor & eMobile) report a 1% jump in market share in the last quarter (p. 62).

- Vodafone’s and Three’s ARPU outstrip that of their rivals (Compare the traffic market shares with revenue markets shares on pp. 62-63).

- Since mobile number porting started nine years ago, nearly 3 million ports have taken place. That’s over half today’s number of subscriptions.

Overall, the quarterly report is a handy resource for telecoms industry professionals, and is worth a look through each quarter.